California Mileage Reimbursement 2025 Calculator. The california state university mileage rate for calendar year 2025 will be 67 cents per mile, which is an increase from the 2025 rate of 65.5 cents per mile. How mileage reimbursement works in california.

Our online calculator tells you exactly how much you can spend, so you can focus on your trip. Fy 2025 per diem rates for los angeles, california.

Modivcare Mileage Reimbursement Pay Schedule 2025 Amye Kellen, Enter your data and then look for the total reimbursement amount at the. Our online calculator tells you exactly how much you can spend, so you can focus on your trip.

California Mileage Reimbursement Requirements Explained (2025), Calculate your per diem allowance for your trip. Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.

Free Mileage Log Templates Smartsheet (2025), M&ie total = breakfast + lunch + dinner + incidentals. This is up from $60,800 in 2025.

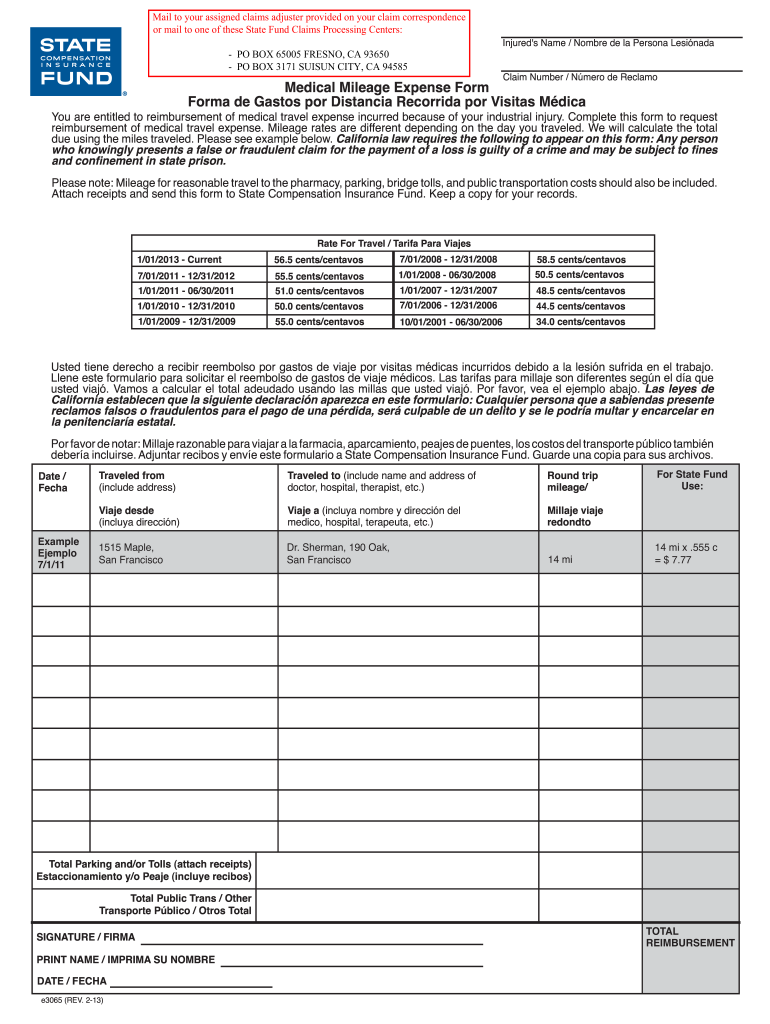

Mileage reimbursement calculator California TravelPerk, The irs has announced the following rates for 2025: Since january 1st, 2025, the irs standard mileage rate has been.67 cents per mile.

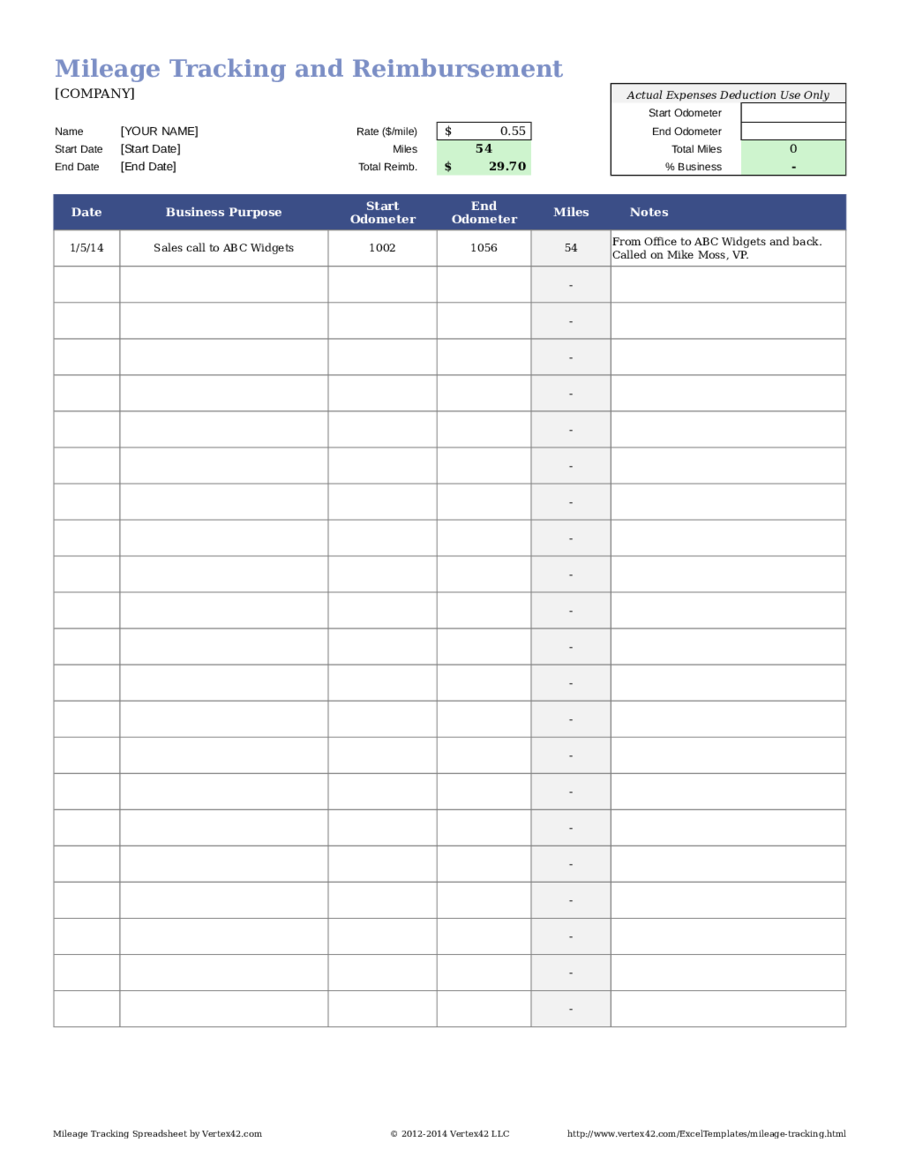

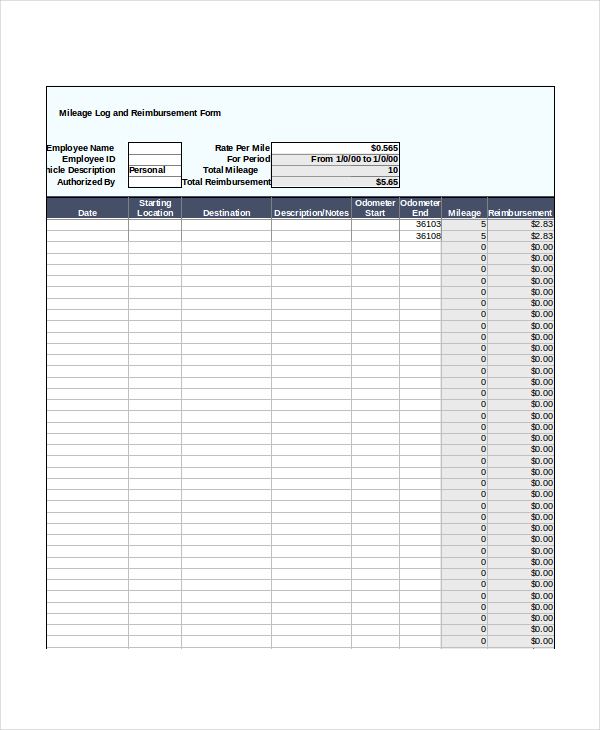

Mileage Reimbursement Form Template for Excel Excel Templates, Fy 2025 per diem rates for los angeles, california. In california, employers are required to fully reimburse you when you use your.

Mileage Reimbursement Calculator Excel Excel Templates, Looking for 2025 mileage rates? Since january 1st, 2025, the irs standard mileage rate has been.67 cents per mile.

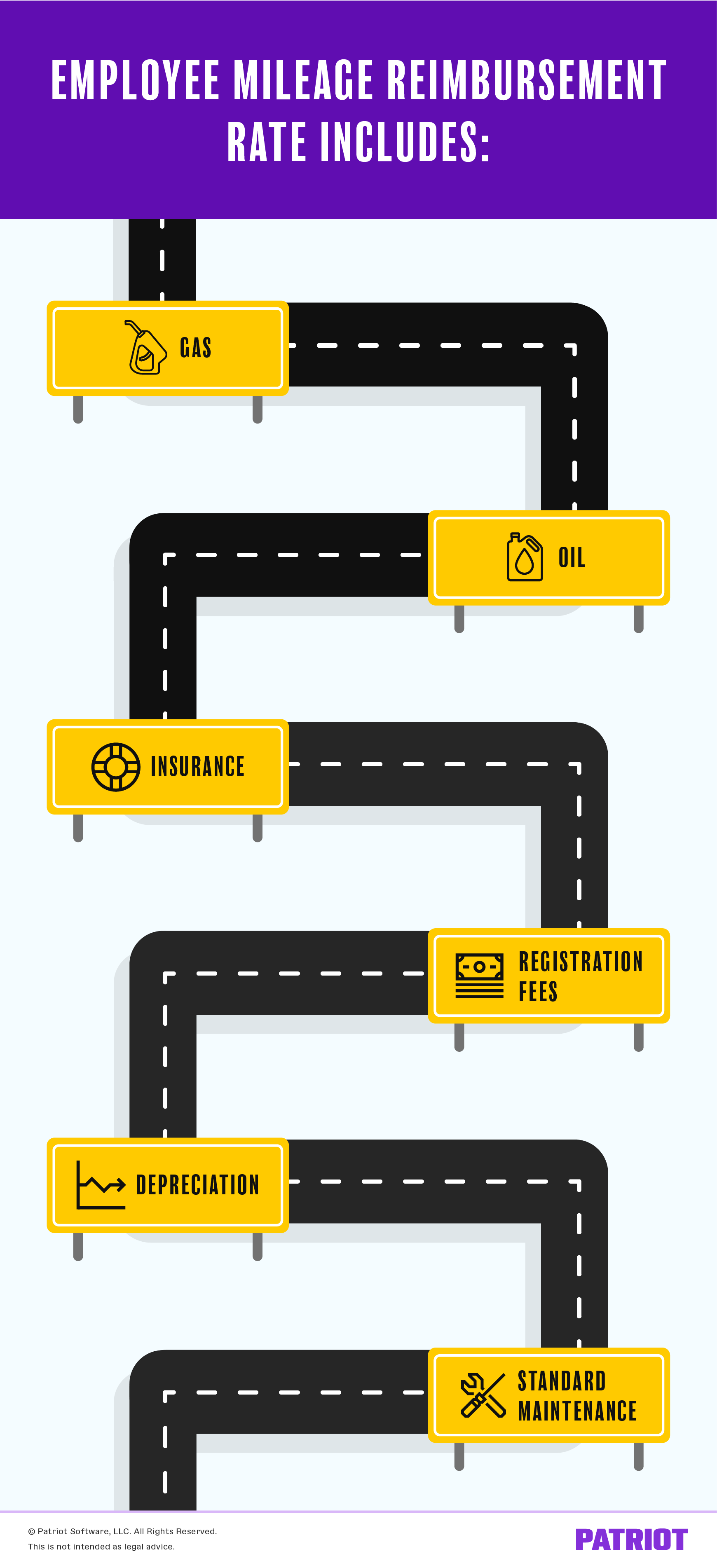

How Does California Mileage Reimbursement Work? KAASS LAW, 21 cents per mile for medical purposes. 67 cents per mile for business purposes.

What is Mileage Reimbursement? 2025 Mileage Reimbursement, First & last day of. Our calculator uses the irs standard mileage rates to automatically calculate your mileage deduction.

Calculate gas mileage reimbursement AmandaMeyah, In california, employers are required to fully reimburse you when you use your. Simply enter your travel dates and.

I a mileage form 2025 Fill out & sign online DocHub, So if one of your employees drives for 10 miles, you would reimburse them $6.70. Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.

Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.